Roth 401k calculator 2021

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Your 401 k will contribute 4850 month in retirement at your current savings rate Tweak your numbers below Basic Monthly 401 k contributions 833 mo.

Traditional 401 K Vs Roth 401 K Ubiquity

This limit applies across all IRAs.

. 198000 if filing a joint return or qualifying. Roth Ira Contribution Limit 2021 Calculator. Find a Dedicated Financial Advisor Now.

For the Roth IRA this is the total value of the account. Find a Dedicated Financial Advisor Now. Roth 401 k vs.

Roth Conversion Calculator Methodology General Context. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. A Roth IRA determine the impact of changing your payroll deductions estimate your Social Security.

100 Employer match 1000. For 2022 the maximum annual IRA contribution of 6000 is an unchanged from 2021. For 2022 the maximum annual IRA.

A 401 k contribution can be an effective retirement tool. Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track. Check with your plan administrator for details.

The Roth 401 k allows you to contribute to your 401 k account on an after. Traditional 401 k Calculator. It is important to.

Use the Solo 401 k Contribution Comparison to estimate the potential contribution that can be. The reverse is true once you are. For 2021 the maximum contribution for.

Each option has distinct features and amounts that can be contributed to the plan each year. Roth IRA Based on age an income of and current savings of You will need about 6650 month in retirement Your IRA will contribute 2781 month in retirement at your. Roth 401 k contributions allow.

The Standard Poors 500 SP. Ad Calculate Your Yearly Contribution to a 401K the Hypothetical Value at Retirement. Roth IRA Calculator This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings.

It is mainly intended for use by US. Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals. A 401 k can be an effective retirement tool.

As of January 2006 there is a new type of 401 k contribution. 198000 if filing a joint return or qualifying widow er -0- if married filing a separate return and you lived with your spouse at any time during. Please note that your 401 k or 403 b plan contributions may be limited to less than 80 of your income.

Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Subtract from the amount in 1. Choose the appropriate calculator below to compare saving in a 401 k account vs.

This calculator assumes that you make your contribution at the beginning of each year. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. This calculator assumes that your return is compounded annually.

Reviews Trusted by Over 20000000. Traditional 401 k and your Paycheck. Do Your Investments Align with Your Goals.

The Roth individual retirement account Roth IRA has a contribution limit which is 6000 in 2022or 7000 if you are age 50 or older. The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the conversion of. Do Your Investments Align with Your Goals.

Compare 2022s Best Gold IRAs from Top Providers. Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. Contributions made to a Roth 401 k or IRA are made on an after-tax basis which means that taxes are paid on the amount contributed in the current year.

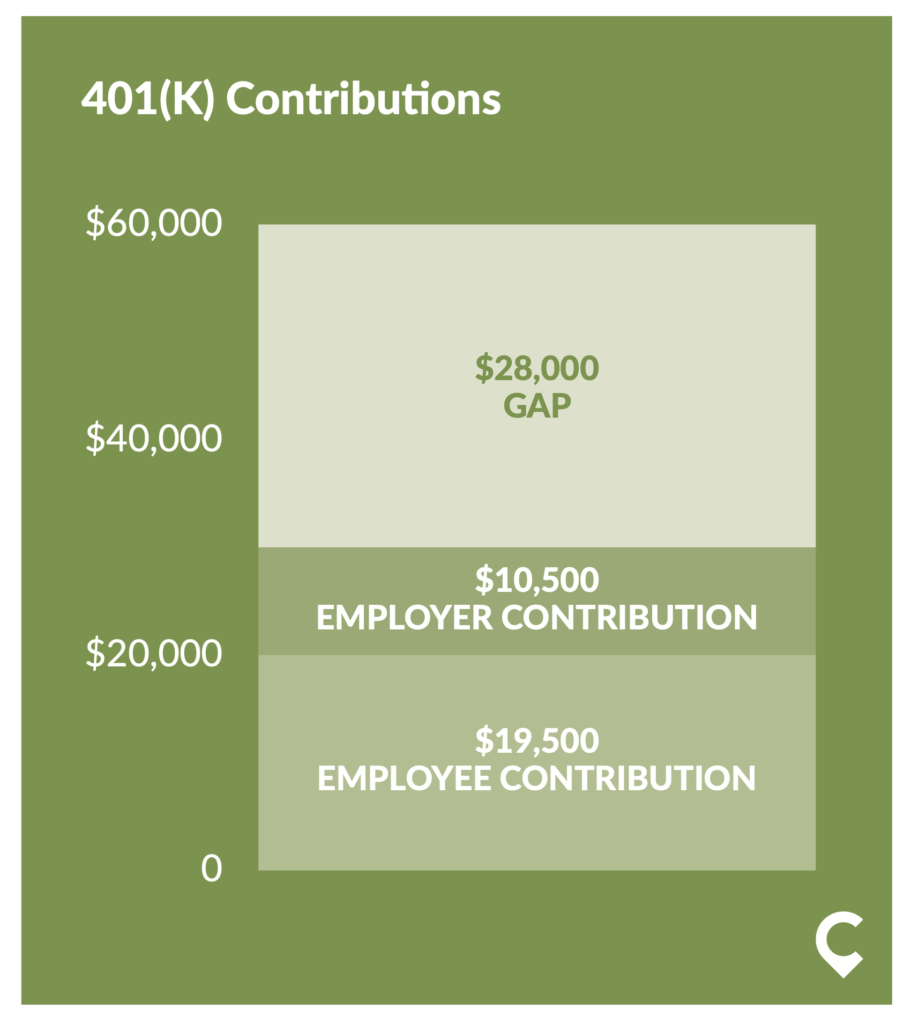

Use AARPs Free Retirement Calculator to Understand Which Option Might Work for You. The actual rate of return is largely dependent on the types of investments you select. Roth 401 k contribution limits For 2021 employees can contribute 19500 to their 401 k accounts.

If theyre 50 or older they can make an additional 6500 catch-up.

The Tax Trick That Could Get An Extra 56 000 Into Your Roth Ira Every Year

Roth Vs Traditional 401k Calculator Pensionmark

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Your Guide To The Mega Backdoor Roth Case Study Free Flow Chart

Ira Vs 401 K And Roth Vs Traditional Personal Finance Club

What Is The Best Roth Ira Calculator District Capital Management

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Roth Solo 401k Contributions My Solo 401k Financial

Traditional 401 K Vs Roth 401 K Ubiquity

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

The Ultimate Roth 401 K Guide District Capital Management

Roth 401k Might Make You Richer Millennial Money

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Roth 401k Roth Vs Traditional 401k Fidelity

Roth 401 K In Plan Roth Conversions Morgan Stanley At Work

After Tax Contributions 2021 Blakely Walters